Blended Finance - A Brief Introduction

Blended finance is the complementary use of grants (or grant-equivalent tools) and other types of financing from private and/or public sources to provide financing to make projects financially viable and/or financially sustainable.

Blended finance funds leverage development finance and grant funding to catalyse new investment at scale, into high impact, market-based solutions.

The de-risking element results in both lower cost of capital and access to additional finance for non-profit organisations delivering social outcomes.

How does blended finance work?

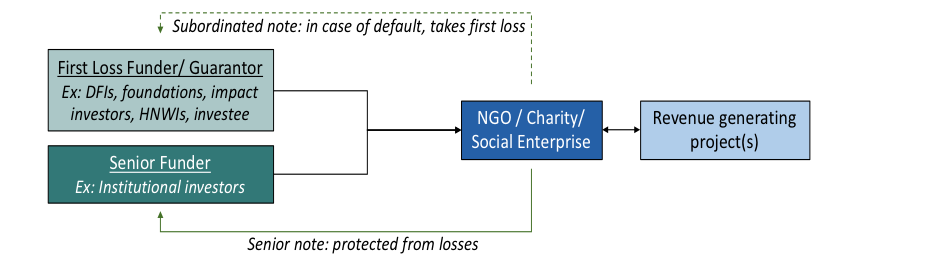

- Impact-first investors (e.g. development finance institutions, foundations, high net worth individuals, even the investee itself) are prepared to accept a greater risk, and/or lower returns

- Finance-first investors (e.g. traditional institutional investors) are interested in supporting impact investments but remain focused on achieving commercial risk adjusted returns

- Guarantees may also be offered

- In case of default, the first loss is taken by the impact-first investors, or guarantor, thereby fully or partially protecting finance-first investors

This approach to structuring finance is known as first loss catalytic capital, or blended finance: it leverages the risk tolerance and favourable terms of impact-first investors to enhance credit, thereby attracting investors for whom otherwise the risk would be too high.

What are the benefits of blended finance?

For the investee:

- Lower cost of capital

- Long-term, predictable source of capital

- Support for capacity building, investment readiness, and post investment management

- Greater flexibility than restricted funding

- Increased capacity to scale and innovate

- Less risky than performance-based contracts

- Diverse network of partners, sector experts, mentors and donors

For the impact first and finance investor:

- De-risking through first loss and guarantees

- Grouping of financial return with social mission

- Increased portfolio diversification

- Regular reporting on social impact generated

- Partnership with organisations possessing local market knowledge and experience

- Lower transaction costs due to investment readiness technical assistance

- Risk management through capacity building technical assistance from DFIs

Examples of blended finance in international development:

Small scale: Equity for Africa leveraged a $1.2m grant from the Dutch government to catalyse an additional $3.6m investment towards equipment finance lending in Tanzania.

Medium scale: Aavishkaar mobilised $94m in blended capital to support BOP entrepreneurs in India. Development funders included IFC, KFW, FMO and CDC while private investors included CISCO and TIAA.

Large scale: The Danish Climate Investment Fund leveraged $94m in public investment to crowd in an additional $142m from institutional investors for climate projects.

A recent report 'Scaling the Use of Guarantees in US Community Investing' by the Global Impact Investing Network (GIIN) points to the contribution that different types of capital can make, where many projects may offer powerful prospects for social and environmental impact, but not meet the needs of more conventional investors who need risk adjusted, market rate returns.

For these opportunities, credit enhancement can unlock private capital to help scale a variety of impact propositions.

Other research such as Catalytic First Loss Capital (GIIN 2013); Shifting the Lens: A De Risking Toolkit for Impact Investment (Bridges Impact+ 2014); Blended Finance Toolkit (The World Economic Forum 2015) and a report by DANIDA (the Danish development agency) are all useful reads on how to mobilise private capital using structured funds.

IFG and blended finance:

In 2014, Investing for Good arranged the world’s first blended finance for social investment in the arts. The fund was supported by the Arts Council England, foundations and private finance.

Investing for Good are currently arranging blended capital facilities for mandates across a wide variety of sectors. These include: finance to support independent media companies in emerging markets, the establishment of a fund to secure long-term affordable workspace for artists in London, a facility to support people living with multiple long-term health conditions, loans to artisanal and small-scale mining communities in emerging markets, and a facility to catalyse the expansion of social enterprise activities for an NGO serving unmet needs in sexual and reproductive health across the Caribbean, and Central and South America.

Investing for Good is a member of Convergence, a platform focused on blended finance transactions that increase private sector investment in emerging markets .

For more information please contact one of the team.

Geoff Burnand, Chief Executive