NEWS

IFG Social Impact Evaluation of the School for Social Entrepreneurs Supports Major Grant Award

We at Investing for Good were delighted that the Big Lottery Fund has renewed its funding for social entrepreneurs, supported by School for Social Entrepreneurs (SSE), with a £2.55m grant.

SSE is a charity with a network of 11 schools, impacting communities across the UK, Canada and India. The charity offer programmes, workshops and short courses, aiming to support individuals on a learning journey, and creating social change together.

We at Investing for Good were delighted that the Big Lottery Fund has renewed its funding for social entrepreneurs, supported by School for Social Entrepreneurs (SSE), with a £2.55m grant.

SSE is a charity with a network of 11 schools, impacting communities across the UK, Canada and India. The charity offer programmes, workshops and short courses, aiming to support individuals on a learning journey, and creating social change together.

The renewal of funding extends Big Lottery Fund’s commitment to the Lloyds Bank Social Entrepreneurs Programme, in partnership with School for Social Entrepreneurs, launched in 2012. The first five years of the programme has supported 1,300 social entrepreneurs. These social entrepreneurs are predicted to reach as many as 1.1 million beneficiaries over five years, according to a social impact review of the programme conducted by CAN Invest and Investing for Good in 2016.

Following a competitive tender, Investing for Good and CAN Invest- a charity committed to helping other charities thrive- were chosen by SSE because both organisations have extensive experience working with intermediary organisations and with the complexities around capturing, measuring impact and attributing impact.

Investing for Good acted as the lead on the project, representing the team and acting as the main point of contact. However, both parties were equal partners during the delivery of the project and worked as one unified team. The partnership made the best use of our respective expertise and experience to date.

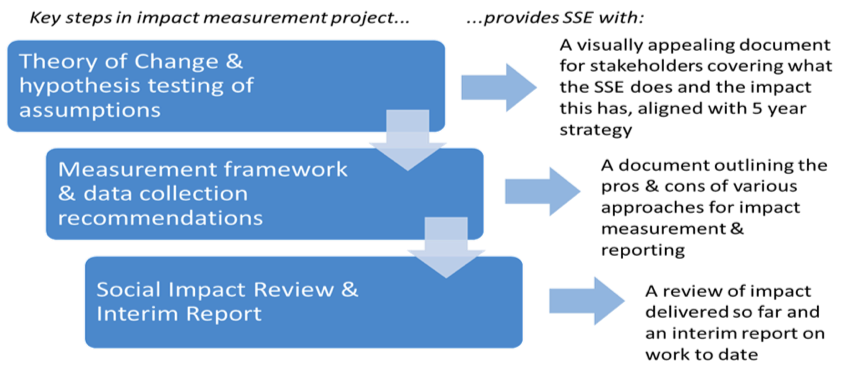

We adopted a hypothesis testing approach whereby we developed and tested a number of assumptions in the Theory of Change and the extent to which the activities that the SSE were doing delivered the outcomes that were initially hypothesised.

Mapping backwards from organisational goals, we tested hypotheses around strategic assumptions, placing emphasis on understanding not only whether SSE activities produced the desired effects, but also how and why, throughout the course of different SSE programmes.

This provided the framework for research for SSE to contribute thought-leadership and become a higher profile, leading voice in the intermediary and educational sectors on excellence in supporting social entrepreneurship.

IFG and CAN Invest used a variety of methods including qualitative research with in-person & telephone interviews, focus groups, surveys, social media approaches, narrative story-telling, and more traditional quantitative, statistical based approaches and study designs.

The review captured the whole spectrum of SSE’s impact: its achievements, success factors, learning elements, progress towards strategic goals, and included an analysis of the various programmes and their performance, and the impact of entrepreneurs to date.

The final report was deliberately designed to catch the eye of a wide audience and encourage readers to find out more.

A social audit can be hugely beneficial to an organisation. Social audits evaluate your current impact processes against best practice, identify any gaps and recommendations for improvements, and give you the opportunity to strengthen relationships with grant makers, social investors and commissioners.

More information on our social audit services can be found at https://www.investingforgood.co.uk/social-audit/

Impact Platforms - Silver bullets or a poisoned chalice?

IFG’s newest recruits recently travelled to Oxford to sample Marmalade, an open-access fringe event to the Skoll World Forum on Social Entrepreneurship.

IFG’s newest recruits recently travelled to Oxford to sample Marmalade, an open-access fringe event to the Skoll World Forum on Social Entrepreneurship.

We dropped into several sessions during day two of the festival, but it was the workshop entitled - “Silver bullets in slingshots: Beyond killer platforms for social good” that intrigued us the most as we cast our eyes over the bumper five-day schedule of workshops, panels and networking events.

Everyone in the room added a social impact tech platform on a post it and it soon became clear there are lots... and lots...

Even before we arrived, the call to arms was set – to truly overcome the planet’s greatest challenges and properly harness the collective groundswell of energy for change, wouldn’t it be better if all those in the impact investment space thought beyond our own, sometimes niche, networks and platforms and considered how greater inter-connectivity could be built into our current work streams? Therefore, to truly create an ecosystem that was greater than the sum of its parts and capable of moving innovations and capital at scale.

The two-hour session was led by Astrid Scholz (CEO, Sphaera) and Audrey Selian (Director, Artha Initiative). We started by crowd-sourcing names of the many, many platforms that exist in the space. The photo below is proof of the fragmentation within the sector and collectively represents an outlay of over £60m on development costs alone, while only one platform has achieved financial sustainability to date.

After a lively debate about the virtues and pitfalls of the aforementioned platforms, our hosts shared an update on a recent project where they had sought to break free of their own organisational silos.

Astrid & Audrey explained how they had come to realise that their respective organisations had essentially been operating at opposite sides of the same coin. For Sphaera, the focus is at the “ideation” stage – identifying, sharing and scaling solutions, while Artha provide the information management platform for entrepreneurs, investors and intermediaries to collaborate. Traditionally, both offerings would function separately with end users needing twice the amount of account logins, time and patience to participate.

The key to the Sphaera- Artha collaboration was opening back-end systems through APIs (application programming interfaces) to share information seamlessly – so the end user can use each of their preferred specialist tools without having to repopulate data over and over. Think using your Google account to speed around the web with a single-sign on.

Of course, a change in mindset away from platforms purely competing with one another is first required; impact communities exist and impact technology exists to connect those communities, but in the market at present no provider is big enough for the data layer to become sufficiently scaled to truly drive outputs. To make this happen either the number of technology platforms will have to consolidate, or the various actors must find a way to share data more successfully and accept that being part of a larger, richer eco-system where each other’s objectives, incentives and financial realities are acknowledged. This is where real progress will be made. The theory extends that that this will also encourage and enable platform creators to offer one service well rather than several services poorly.

Clearly there are real challenges over data sharing and other trust issues that will need to be worked through sensitively, but the aspiration is to make this sector more collaborative and efficient by providing participants the tools to act in this way.

Our hosts promised to update us over the summer on the progress of their project and we look forward to seeing the outputs of case studies that showcase how organisations have fared in the real world and the opportunities that greater access and API’s can offer to us all.