Introducing The Good Analyst

A methodology for impact analysis and a set of guidelines for measuring and reporting on impact

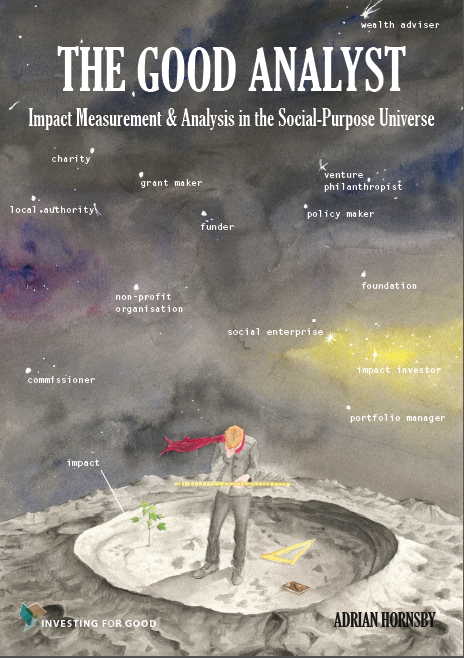

The Good Analyst methodology draws on a decade of our impact research to provide an end-to-end set of social impact practices for use by:

- Social-purpose organisations, including charities and social enterprises and NGOs

- Providers of capital to the social sector, such as grantfunders, commissioners of social services, and foundations

- Experts engaged with the sector, including policy makers and advisers, regulators, consultants to charities and donors, and academics and impact researchers

Practical guidelines for capturing your impact

“We’re excited to be drawing on the methodology of The Good Analyst which can be used across our portfolio, from the very large investments to the very small”

A guide to The Good Analyst methodology (previously known as MIAA) was published in book form as The Good Analyst in 2012, which incorporates the Investing for Good Guidelines for How to Measure and Report Social Impact and is accompanied by the Dictionary of Indicators. The Good Analyst argues that a different approach is needed to effect a more sustainable relationship between money, impact and society.

More about Good Analyst

Investing for Good spent over five years researching and developing a proprietary impact analysis and assessment tool. Our resulting Good Analyst methodology underwent three years of refinement and application and has been used to analyse over 100 impact investments of various sizes, representing over $1bn of socially-motivated capital.

It is used as an impact due diligence and analysis tool for our own Social Bond Programme, providing investors with annual impact reports on each issuer. We are also in the process of develop clear relationships between impact analysis and the pricing of social investments.

A consistent, systematic set of processes

The Good Analyst is not a formula, but an analytical framework that is designed to ensure assessments are arrived at through a consistent, systematic procedure. It is structured around three key perspectives: (1) the social-purpose organisation generating the impact; (2) the beneficiary receiving the impact; and (3) the world beyond the organisation and its direct beneficiaries into which the impact is ultimately absorbed. The assessment is divided into three sections based on these perspectives:

Mission Fulfilment

With respect to the organisation’s own mission, to what extent is that mission being effectively fulfilled by the organisation’s activities and operations?Beneficiary perspective

To what extent are beneficiaries experiencing positive change in their lives as a result of the organisation’s activities?Wider impact

How is the change playing out in wider contexts and environments, and what are the implications for local and societal benefits?

Analysis of these three perspectives takes place according to a weighted scoring system of over 100 individual considerations. The final output is akin to an impact rating, which allows placement of organisations and their impact across a single plane to compare their impact performance. Further, the Good Analyst is designed for repeat use such that the impact of an organisation can be tracked over time. This allows investors to use The Good Analyst as a tool alongside The Good Investor in order to integrate impact into their investment decision-making process and thereby lays the foundation for coupling the use of capital to positive social change.