NEWS

Impact Platforms - Silver bullets or a poisoned chalice?

IFG’s newest recruits recently travelled to Oxford to sample Marmalade, an open-access fringe event to the Skoll World Forum on Social Entrepreneurship.

IFG’s newest recruits recently travelled to Oxford to sample Marmalade, an open-access fringe event to the Skoll World Forum on Social Entrepreneurship.

We dropped into several sessions during day two of the festival, but it was the workshop entitled - “Silver bullets in slingshots: Beyond killer platforms for social good” that intrigued us the most as we cast our eyes over the bumper five-day schedule of workshops, panels and networking events.

Everyone in the room added a social impact tech platform on a post it and it soon became clear there are lots... and lots...

Even before we arrived, the call to arms was set – to truly overcome the planet’s greatest challenges and properly harness the collective groundswell of energy for change, wouldn’t it be better if all those in the impact investment space thought beyond our own, sometimes niche, networks and platforms and considered how greater inter-connectivity could be built into our current work streams? Therefore, to truly create an ecosystem that was greater than the sum of its parts and capable of moving innovations and capital at scale.

The two-hour session was led by Astrid Scholz (CEO, Sphaera) and Audrey Selian (Director, Artha Initiative). We started by crowd-sourcing names of the many, many platforms that exist in the space. The photo below is proof of the fragmentation within the sector and collectively represents an outlay of over £60m on development costs alone, while only one platform has achieved financial sustainability to date.

After a lively debate about the virtues and pitfalls of the aforementioned platforms, our hosts shared an update on a recent project where they had sought to break free of their own organisational silos.

Astrid & Audrey explained how they had come to realise that their respective organisations had essentially been operating at opposite sides of the same coin. For Sphaera, the focus is at the “ideation” stage – identifying, sharing and scaling solutions, while Artha provide the information management platform for entrepreneurs, investors and intermediaries to collaborate. Traditionally, both offerings would function separately with end users needing twice the amount of account logins, time and patience to participate.

The key to the Sphaera- Artha collaboration was opening back-end systems through APIs (application programming interfaces) to share information seamlessly – so the end user can use each of their preferred specialist tools without having to repopulate data over and over. Think using your Google account to speed around the web with a single-sign on.

Of course, a change in mindset away from platforms purely competing with one another is first required; impact communities exist and impact technology exists to connect those communities, but in the market at present no provider is big enough for the data layer to become sufficiently scaled to truly drive outputs. To make this happen either the number of technology platforms will have to consolidate, or the various actors must find a way to share data more successfully and accept that being part of a larger, richer eco-system where each other’s objectives, incentives and financial realities are acknowledged. This is where real progress will be made. The theory extends that that this will also encourage and enable platform creators to offer one service well rather than several services poorly.

Clearly there are real challenges over data sharing and other trust issues that will need to be worked through sensitively, but the aspiration is to make this sector more collaborative and efficient by providing participants the tools to act in this way.

Our hosts promised to update us over the summer on the progress of their project and we look forward to seeing the outputs of case studies that showcase how organisations have fared in the real world and the opportunities that greater access and API’s can offer to us all.

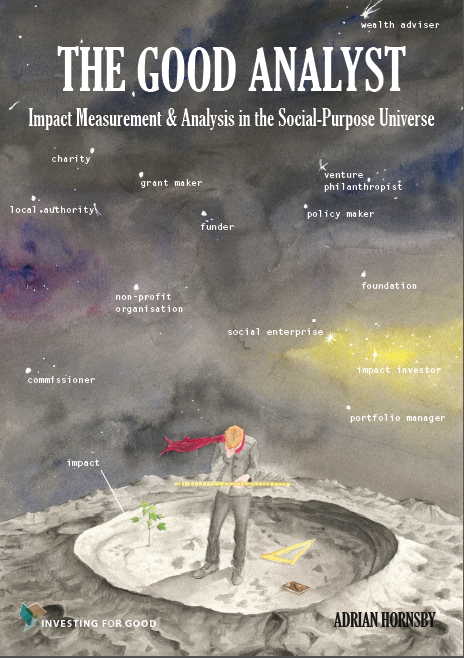

Introducing The Good Analyst

Good Analyst is a methodology for impact analysis and a set of guidelines for measuring and reporting on impact

A methodology for impact analysis and a set of guidelines for measuring and reporting on impact

The Good Analyst methodology draws on a decade of our impact research to provide an end-to-end set of social impact practices for use by:

- Social-purpose organisations, including charities and social enterprises and NGOs

- Providers of capital to the social sector, such as grantfunders, commissioners of social services, and foundations

- Experts engaged with the sector, including policy makers and advisers, regulators, consultants to charities and donors, and academics and impact researchers

Practical guidelines for capturing your impact

“We’re excited to be drawing on the methodology of The Good Analyst which can be used across our portfolio, from the very large investments to the very small”

A guide to The Good Analyst methodology (previously known as MIAA) was published in book form as The Good Analyst in 2012, which incorporates the Investing for Good Guidelines for How to Measure and Report Social Impact and is accompanied by the Dictionary of Indicators. The Good Analyst argues that a different approach is needed to effect a more sustainable relationship between money, impact and society.

More about Good Analyst

Investing for Good spent over five years researching and developing a proprietary impact analysis and assessment tool. Our resulting Good Analyst methodology underwent three years of refinement and application and has been used to analyse over 100 impact investments of various sizes, representing over $1bn of socially-motivated capital.

It is used as an impact due diligence and analysis tool for our own Social Bond Programme, providing investors with annual impact reports on each issuer. We are also in the process of develop clear relationships between impact analysis and the pricing of social investments.

A consistent, systematic set of processes

The Good Analyst is not a formula, but an analytical framework that is designed to ensure assessments are arrived at through a consistent, systematic procedure. It is structured around three key perspectives: (1) the social-purpose organisation generating the impact; (2) the beneficiary receiving the impact; and (3) the world beyond the organisation and its direct beneficiaries into which the impact is ultimately absorbed. The assessment is divided into three sections based on these perspectives:

Mission Fulfilment

With respect to the organisation’s own mission, to what extent is that mission being effectively fulfilled by the organisation’s activities and operations?Beneficiary perspective

To what extent are beneficiaries experiencing positive change in their lives as a result of the organisation’s activities?Wider impact

How is the change playing out in wider contexts and environments, and what are the implications for local and societal benefits?

Analysis of these three perspectives takes place according to a weighted scoring system of over 100 individual considerations. The final output is akin to an impact rating, which allows placement of organisations and their impact across a single plane to compare their impact performance. Further, the Good Analyst is designed for repeat use such that the impact of an organisation can be tracked over time. This allows investors to use The Good Analyst as a tool alongside The Good Investor in order to integrate impact into their investment decision-making process and thereby lays the foundation for coupling the use of capital to positive social change.